Disclaimer

This press release includes forward-looking statements within the meaning of applicable securities laws, reflecting the current expectations of UNXE238 Corp. with respect to its Projects and the uranium market. These statements may involve, but are not limited to, forecasts, resource estimates, development timelines, and strategic plans, and are identified by terms such as “expects,” “plans,” “anticipates,” “estimates,” or similar language. Such statements are inherently subject to known and unknown risks, uncertainties, and assumptions, including but not limited to market volatility, regulatory approvals, exploration results, and operational risks.

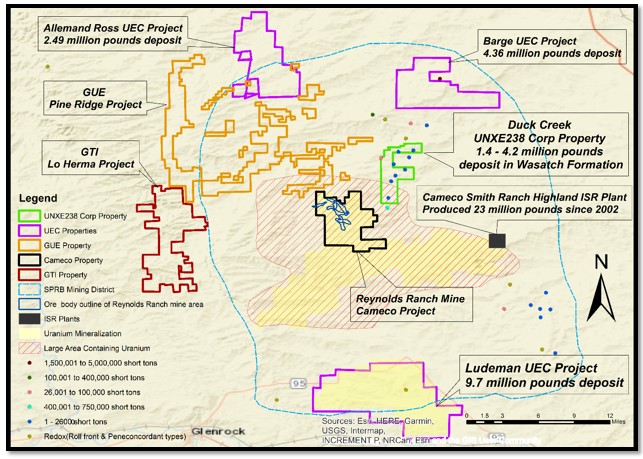

Converse County, Wyoming – [18th April 2025] – As the global energy transition accelerates, UNXE238 Corp. proudly unveils its flagship uranium asset, the Duck Creek Project—a strategically located, high-potential uranium deposit in the Southern Powder River Basin (SPRB), Wyoming. Positioned among some of the most prolific uranium mines in the United States, Duck Creek presents a rare opportunity for investors looking to capitalize on the growing demand for secure, domestic uranium supply.

Why Duck Creek? A Strategic Uranium Asset in the Heart of America’s Energy Belt

With nations increasingly shifting toward nuclear power as a clean, reliable energy source, uranium demand is skyrocketing. The Duck Creek Project is a prime investment opportunity, uniquely positioned amid established uranium production centers and major deposits, including:

🔹 Ludeman, Barge, and Allemand Ross Projects (UEC) – 5 to 12 miles away, actively developed ISR uranium projects with significant resources.

🔹 Smith-Reynold Ranch Deposits – Only 1 mile northeast, adding to the regional uranium richness.

🔹 Cameco’s Smith Ranch-Highland ISR Plant – A top-producing U.S. uranium facility, yielding 23 million pounds of U₃O₈ since 2002.

🔹 Lo Herma Project – 11 miles west, historically known for high-grade roll-front uranium deposits.

🔹 Pine Ridge Project – 2 miles west, demonstrating the expansive uranium potential across the region

This further increase the importance of duck creek Recent deal of 22.5 million USD in JV partnership of Global Uranium and Snow Lake Energy has been cracked. These both parties acquire a Pine Ridge Uranium Project from Stake Holder Energy LLC .

With existing infrastructure, proven uranium-rich geology, and a prime location among industry leaders, Duck Creek represents an unparalleled low-risk, high-reward investment.

Strategic Positioning of Duck Creek Project

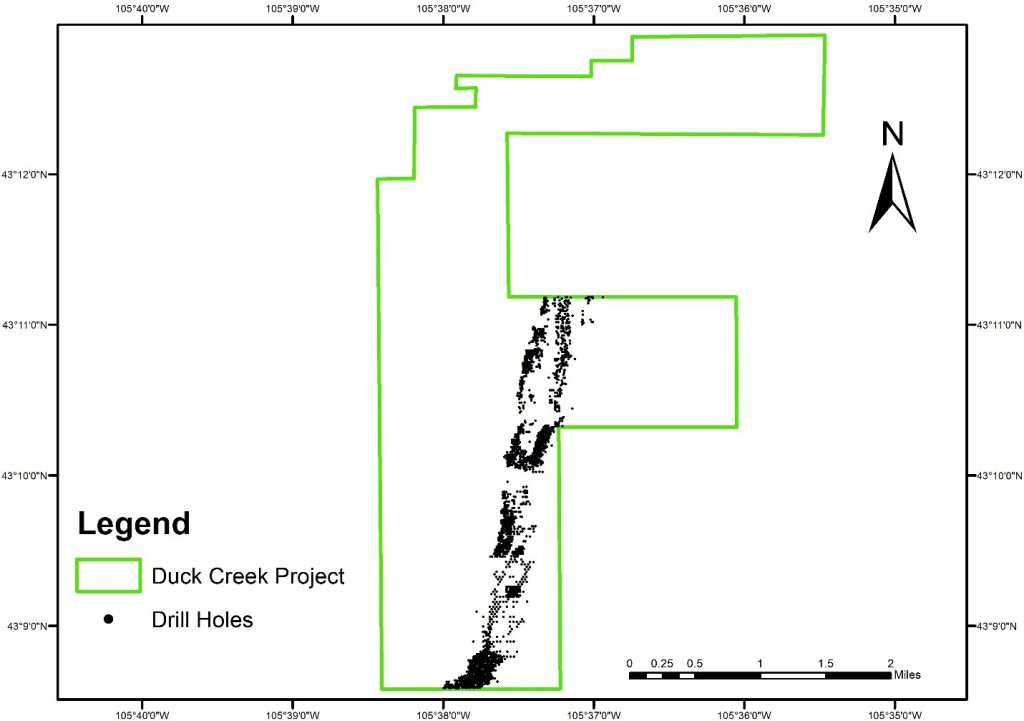

✅ Larger land package: Duck Creek covers 4,160 acres, providing room for extensive development.

✅ Extensive drilling data: 3,508 drill holes, with significant uranium mineralization, making it attractive for investors.

✅ Wyoming – A Uranium-Friendly State: Converse County is a well-known uranium hub with ongoing industry activities.

Figure-1: Location Map of Duck Creek Project

Robust Resource Estimates & Significant Expansion Potential

Historical data indicates that Duck Creek holds a strong uranium resource base, with potential for substantial growth:

✅ 1.4 million to 4.2 million pounds of U₃O₈ estimated from existing drill data.

✅ 3,508 historical drill holes completed, with 1,492 analyzed for uranium-bearing zones.

✅ Mineralization hosted in the Wasatch Formation,

✅ Untapped potential in the Fort Union Formation, similar to deeper, high-yield deposits in the region.

Historical mining activity confirms high-grade uranium deposits left unmined, presenting an extraordinary opportunity to revitalize these assets under a modern exploration and development framework.

Figure-2: Historical drill holes in Duck Creek Project

Advancing Toward Development – A Clear Roadmap for Growth

UNXE238 Corp. is actively seeking Strategic Partnerships & JV Opportunities: Leverage industry collaborations to fast-track development and de-risk investment.

Phase 1 – Verification & Expansion Drilling: Confirm and expand known uranium resources through advanced geophysical logging and targeted drilling of Wasatch Formation..

Phase 2: Confirm reserves in the Wasatch Formation and conduct a thorough evaluation of the Fort Union Formation. Given its potential and the ongoing interest from surrounding projects, prioritize an aggressive drilling campaign to fully delineate the ore body. Assess its feasibility for ISR amenable project to maximize recovery and viability.

High-Pressure Slurry Ablation (HPSA) Testing: UNXE238 Corp. plans to evaluate High-Pressure Slurry Ablation technology to enhance uranium recovery efficiency. This process could improve ore processing by reducing waste and increasing uranium extraction rates, making the Duck Creek Project even more economically and environmentally viable.

“Duck Creek is positioned to be a game-changer in the U.S. uranium market. With growing nuclear energy demand and increasing geopolitical concerns around uranium supply, this project represents a timely and strategic investment opportunity,”

said Munazzam Ali Mahar, Ph.D., Founder and Chairman at UNXE238 Corp. “We are laser-focused on unlocking its full potential and are actively seeking partners to help drive this project forward.”

Investor Opportunity – Partner with UNXE238 Corp. in the Future of U.S. Uranium

With the U.S. government prioritizing domestic uranium production and uranium prices on an upward trajectory, the Duck Creek Project is a golden opportunity for investors looking to secure a stake in the future of nuclear energy. UNXE238 Corp. is actively welcoming joint venture partnerships and investment inquiries to support the next phase of development.

About UNXE238 Corp.

UNXE238 Corp. is an emerging uranium exploration company focused on high-value assets in North America. We are committed to sustainability and responsible resource development to support domestic uranium production and the clean energy transition.

For information contact

info@unxe238corp.com

Cautionary Note Regarding Historical Mineral Resource Estimates

(Disclosure in accordance with CIM and NI 43-101 guidelines)

The mineral resource estimate disclosed herein is preliminary in nature, derived from historical drill hole data. This estimate is not compliant with NI 43-101 and does not meet the criteria for Measured and Indicated (M&I) resources under the CIM Definition Standards. The Company is not treating the estimate as a current mineral resources and reserves